In the realm of personal finance, securing affordable car insurance is paramount. For Illinois residents, navigating the insurance landscape can be a daunting task. This comprehensive guide delves into the intricacies of cheap car insurance in Illinois, empowering drivers with the knowledge to make informed decisions and safeguard their financial well-being.

With a focus on practicality and value, this guide unravels the complexities of insurance policies, discounts, and strategies to minimize premiums. Readers will embark on a journey of discovery, gaining insights into the factors that shape insurance costs and the nuances of comparing quotes.

Illinois Car Insurance Market Overview

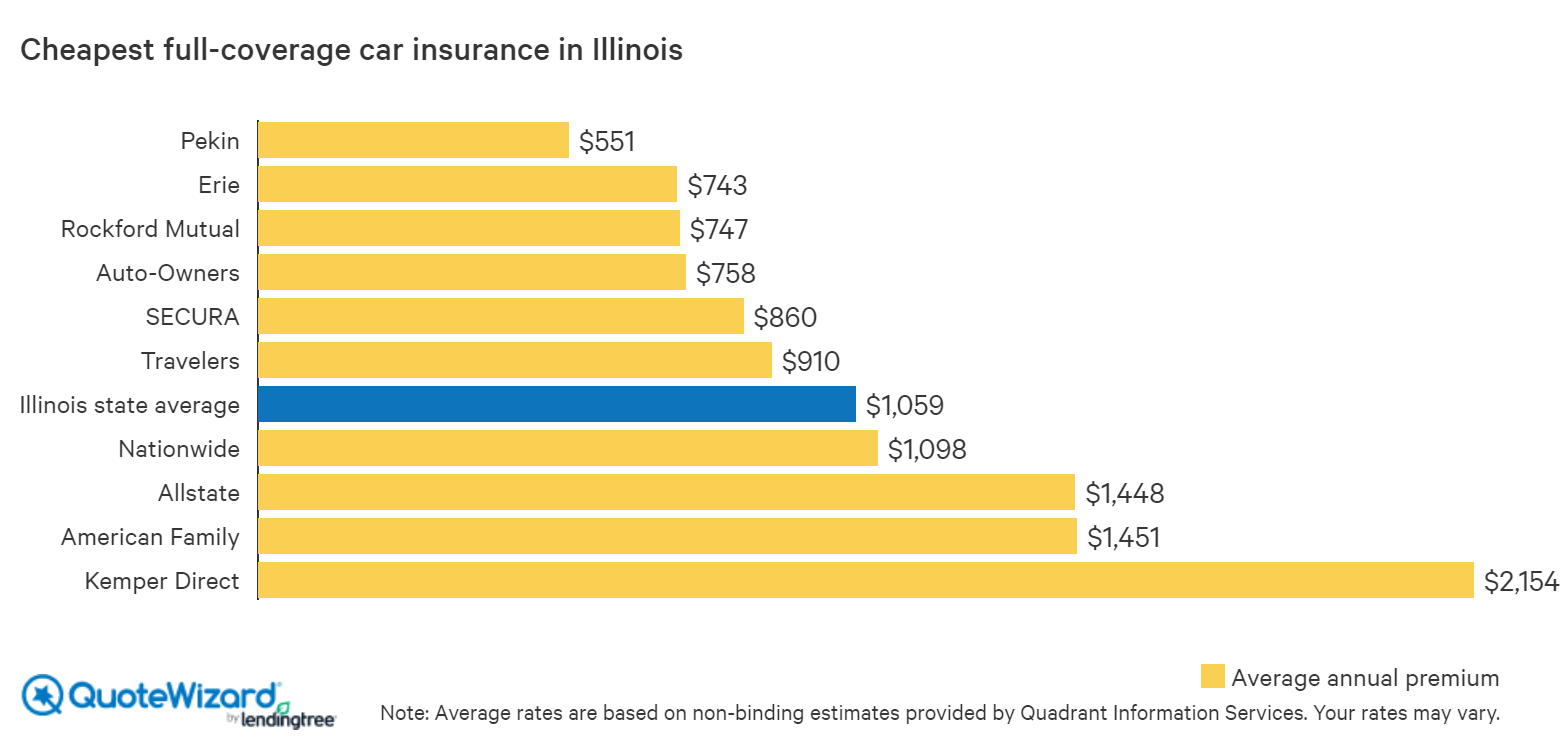

The Illinois car insurance market is highly competitive, with numerous insurance providers offering a wide range of coverage options. The average annual premium in Illinois is $1,200, which is slightly higher than the national average. However, rates can vary significantly depending on factors such as the driver’s age, driving history, and the type of vehicle being insured.

The Illinois Department of Insurance regulates the car insurance industry in the state. The department sets minimum coverage requirements and ensures that insurance companies are financially sound. In recent years, the department has implemented a number of reforms aimed at making car insurance more affordable and accessible for Illinois drivers.

Top 5 Car Insurance Providers in Illinois

The top 5 car insurance providers in Illinois, based on market share, are:

- State Farm

- Allstate

- Geico

- Progressive

- Farmers

These companies offer a variety of coverage options and competitive rates. They also have a strong presence in the state, with numerous agents and customer service representatives available to assist drivers.

Factors Affecting Car Insurance Rates in Illinois

Car insurance premiums in Illinois are influenced by various factors that reflect the risk associated with insuring a particular driver and vehicle. Understanding these factors can help drivers make informed decisions to potentially lower their insurance costs.

Driving History

A driver’s driving history is a major factor in determining car insurance rates. Drivers with clean driving records, free of accidents and traffic violations, are typically eligible for lower premiums compared to those with poor driving records.

Age

Age is another key factor that affects car insurance rates. Younger drivers, typically under the age of 25, are considered higher-risk drivers and face higher premiums due to their lack of experience and higher likelihood of being involved in accidents.

Location

The location where a vehicle is registered and primarily driven also impacts insurance rates. Areas with higher rates of accidents, traffic congestion, and crime tend to have higher insurance premiums. Urban areas, for instance, generally have higher rates than rural areas.

Vehicle Type

The type of vehicle insured also plays a role in determining insurance rates. Vehicles that are more expensive to repair or replace, such as luxury cars or sports cars, typically have higher premiums compared to more affordable and common vehicles.

Top Cheap Car Insurance Providers in Illinois

Illinois drivers seeking affordable car insurance have numerous options to consider. Several reputable companies offer competitive rates, extensive coverage, and excellent customer service.

When selecting a car insurance provider, it’s crucial to compare quotes from multiple insurers and consider factors such as coverage options, discounts, and customer ratings.

State Farm

- Coverage: State Farm offers a wide range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist protection.

- Discounts: State Farm provides various discounts, such as multi-car, safe driver, and defensive driving discounts.

- Customer Service: State Farm consistently receives high customer satisfaction ratings for its responsive and helpful service.

GEICO

- Coverage: GEICO offers comprehensive coverage options, including roadside assistance, rental car reimbursement, and accident forgiveness.

- Discounts: GEICO provides numerous discounts, including discounts for military members, federal employees, and students.

- Customer Service: GEICO has a user-friendly website and mobile app for easy policy management and claims reporting.

Progressive

- Coverage: Progressive offers a wide range of coverage options, including gap insurance, rideshare insurance, and pet injury coverage.

- Discounts: Progressive provides discounts for homeowners, safe drivers, and usage-based insurance programs.

- Customer Service: Progressive has a strong reputation for providing personalized and efficient customer service.

Comparing Car Insurance Quotes

Comparing car insurance quotes is essential for finding the most affordable and comprehensive coverage for your needs. By obtaining quotes from multiple insurers, you can compare premiums, deductibles, and coverage options to make an informed decision.

Factors Affecting Car Insurance Rates

Several factors influence car insurance premiums, including:

- Driving history: Accidents, traffic violations, and DUI convictions can increase premiums.

- Age: Young and elderly drivers typically pay higher premiums due to perceived higher risk.

- Vehicle type: Sports cars, luxury vehicles, and high-performance cars generally have higher premiums.

- Coverage level: Higher coverage limits and additional coverages (e.g., rental car reimbursement) increase premiums.

- Location: Areas with high crime rates or traffic congestion often have higher premiums.

Getting Accurate Quotes

To get the most accurate and competitive quotes, provide insurers with the following information:

- Your personal information (age, driving history, address)

- Vehicle information (make, model, year, mileage)

- Coverage needs (liability, collision, comprehensive)

- Desired deductible

Comparing Premiums

Once you have quotes from multiple insurers, compare the following:

| Insurer | Premium | Deductible | Coverage Limits |

|---|---|---|---|

| Company A | $1,200 | $500 | $100,000/$300,000 |

| Company B | $1,000 | $1,000 | $50,000/$100,000 |

| Company C | $1,400 | $250 | $200,000/$500,000 |

Step-by-Step Guide to Comparing Quotes

- Gather information about your driving history, vehicle, and coverage needs.

- Contact multiple insurers for quotes.

- Compare premiums, deductibles, and coverage limits.

- Consider the reputation and customer service of each insurer.

- Choose the policy that best meets your needs and budget.

Common Questions

- Why is it important to compare car insurance quotes? Comparing quotes allows you to find the most affordable and comprehensive coverage for your needs.

- What factors affect car insurance premiums? Driving history, age, vehicle type, coverage level, and location are key factors that influence premiums.

- How can I get the most accurate quotes? Provide insurers with accurate and detailed information about your driving history, vehicle, and coverage needs.

- What should I consider when comparing quotes? Compare premiums, deductibles, coverage limits, and the reputation of each insurer.

Discounts and Savings on Car Insurance

Illinois car insurance providers offer a wide range of discounts and savings to help drivers reduce their premiums. These discounts can be based on various factors, including driving habits, vehicle safety features, and policyholder demographics. Understanding and utilizing these discounts can significantly lower your car insurance costs.

To qualify for these discounts, drivers must typically meet certain criteria or take specific actions. It’s important to inquire with your insurance provider about the specific requirements and eligibility for each discount.

Safe Driving Discounts

- Accident-free discount: Drivers with a clean driving record, free of accidents or traffic violations, are eligible for this discount.

- Defensive driving course discount: Completing an approved defensive driving course can demonstrate responsible driving habits and qualify drivers for a discount.

- Good student discount: Young drivers who maintain a high grade point average (GPA) may be eligible for a discount.

Vehicle Safety Discounts

- Anti-lock brake discount: Vehicles equipped with anti-lock brakes (ABS) are less likely to be involved in accidents, making drivers eligible for a discount.

- Airbag discount: Vehicles with airbags provide enhanced safety, reducing the risk of injuries in accidents and qualifying drivers for a discount.

- Anti-theft device discount: Installing an anti-theft device, such as an alarm or immobilizer, can deter theft and qualify drivers for a discount.

Policyholder Discounts

- Multi-car discount: Insuring multiple vehicles with the same provider can result in a discount on each policy.

- Multi-policy discount: Bundling car insurance with other insurance policies, such as homeowners or renters insurance, can qualify drivers for a discount.

- Loyalty discount: Maintaining continuous coverage with the same insurance provider for an extended period may result in a loyalty discount.

Other Discounts

- Low mileage discount: Drivers who drive fewer miles annually may qualify for a discount.

- Pay-in-full discount: Paying your annual premium in one lump sum, rather than monthly installments, can result in a discount.

- Electronic payment discount: Signing up for automatic electronic payments can qualify drivers for a discount.

Maximizing these discounts and savings requires proactive effort from drivers. By understanding the eligibility criteria and taking steps to qualify, drivers can significantly reduce their car insurance premiums in Illinois.

Bundling Car Insurance with Other Policies

Bundling car insurance with other insurance policies, such as homeowners or renters insurance, can offer several benefits, including cost savings, convenience, and coverage advantages.

Potential Savings

Bundling policies can often lead to significant savings on your overall insurance costs. Insurance companies typically offer discounts for customers who bundle multiple policies with them. These discounts can range from 5% to 25%, depending on the insurance company and the specific policies being bundled.

For example, if you bundle your car insurance with your homeowners insurance, you could save an average of 15% on your car insurance premium. This could amount to hundreds of dollars in savings over the course of a year.

Coverage Advantages

In addition to saving money, bundling car insurance with other policies can also provide coverage advantages. For example, if you bundle your car insurance with your homeowners insurance, you may be able to get additional coverage for your car, such as:

- Coverage for personal belongings in your car

- Coverage for damage to your car caused by a covered peril, such as a fire or theft

- Coverage for medical expenses if you are injured in a car accident

Bundling your car insurance with other policies can also make it easier to manage your insurance needs. You will only have to deal with one insurance company for all of your insurance policies, which can save you time and hassle.

How to Determine if Bundling is Right for You

Whether or not bundling car insurance with other policies is right for you depends on a number of factors, including:

- The cost of bundling versus separate policies

- The coverage you need

- Your personal preferences

If you are considering bundling car insurance with other policies, it is important to compare the cost of bundling versus separate policies. You should also make sure that the coverage you need is available through a bundled policy. Finally, you should consider your personal preferences. Some people prefer to bundle their insurance policies with one company, while others prefer to keep their policies separate.

Insurance Companies that Offer Bundling Discounts

Many insurance companies offer bundling discounts. Some of the most popular insurance companies that offer bundling discounts include:

- State Farm

- Geico

- Progressive

- Allstate

- Farmers

If you are interested in bundling car insurance with other policies, you should contact your insurance company to see if they offer bundling discounts.

Sample Conversation between a Customer and an Insurance Agent about Bundling Car Insurance

Customer: I am interested in bundling my car insurance with my homeowners insurance. Can you tell me more about the discounts and coverage advantages that are available?

Insurance Agent: Sure. Bundling your car insurance with your homeowners insurance can save you up to 25% on your car insurance premium. You may also be eligible for additional coverage, such as coverage for personal belongings in your car and coverage for damage to your car caused by a covered peril.

Customer: That sounds great. How do I go about bundling my policies?

Insurance Agent: You can bundle your policies by calling your insurance company or visiting their website. You will need to provide your policy numbers and information about the policies you want to bundle.

Customer: Thank you. I will contact my insurance company today to learn more about bundling my policies.

Raising Deductibles to Lower Premiums

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can lower your insurance premiums. This is because the insurance company is taking on less risk by having you pay more upfront.

The key is to find the right deductible level for your needs. If you choose a deductible that is too high, you may end up paying more out of pocket in the event of an accident. On the other hand, if you choose a deductible that is too low, you may not save much on your premiums.

Determining the Optimal Deductible Level

There is no one-size-fits-all answer when it comes to determining the optimal deductible level. The best way to find the right deductible for you is to compare quotes from different insurance companies. Be sure to consider your budget, your driving history, and the type of coverage you need.

Defensive Driving Courses and Insurance Discounts

Defensive driving courses are designed to teach drivers how to anticipate and avoid hazards on the road. By taking these courses, drivers can learn how to identify and react to potential dangers, which can help them reduce their risk of accidents.

Many insurance companies offer discounts to drivers who have completed defensive driving courses. These discounts can range from 5% to 15%, and they can be applied to both new and existing policies. To qualify for a discount, drivers must typically complete a course that is approved by their insurance company.

Course Content

Defensive driving courses typically cover a variety of topics, including:

- Hazard recognition

- Defensive driving techniques

- Skid control

- Speed management

- Distracted driving

- Drunk driving

Provide examples of specific traffic violations that can lead to increased insurance rates

Traffic violations can significantly impact insurance rates, as they indicate a higher risk of accidents. Examples of common violations that can lead to increased premiums include:

- Speeding

- Running a red light

- Failure to yield

- Reckless driving

- Driving under the influence (DUI)

Consequences of Traffic Violations on Insurance Rates

The table below illustrates the potential consequences of various traffic violations on insurance rates:

| Violation | Insurance Rate Increase |

|---|---|

| Speeding (10 mph over the limit) | 5-10% |

| Running a red light | 10-20% |

| Failure to yield | 5-10% |

| Reckless driving | 20-30% |

| DUI | 50-100% or more |

It’s important to note that the actual impact on insurance rates can vary depending on factors such as the driver’s age, driving history, and location.

Car Safety Features and Insurance Premiums

Certain car safety features can significantly impact insurance rates. Airbags, anti-lock brakes (ABS), and electronic stability control (ESC) are common features that may qualify for discounts.

Insurance companies assess the risk associated with different safety features based on their effectiveness in preventing accidents and reducing the severity of crashes. Features that enhance vehicle stability, reduce stopping distances, and protect occupants in collisions are typically rewarded with lower premiums.

Safety Features and Discounts

According to the Insurance Institute for Highway Safety (IIHS), vehicles with airbags have a 25% lower risk of driver fatalities in frontal crashes compared to vehicles without airbags. ABS reduces the risk of fatal crashes by 35% and ESC by 56%.

Many insurance companies offer discounts for the following safety features:

- Airbags (driver, passenger, side, and curtain)

- Anti-lock brakes (ABS)

- Electronic stability control (ESC)

- Lane departure warning

- Forward collision warning

- Adaptive headlights

- Blind spot monitoring

The discount percentage varies by insurance company and the specific features installed in the vehicle. However, discounts can range from 5% to 20% or more.

Drivers can maximize their insurance savings by choosing vehicles with the latest safety features. By investing in a safer car, they not only protect themselves and their passengers but also reduce their insurance costs in the long run.

Online Car Insurance Shopping

Online car insurance shopping offers numerous advantages, including convenience, time savings, and access to a wider range of options. It allows you to compare quotes from multiple insurance companies, research their offerings, and make informed decisions without leaving your home.

Finding Reputable Insurance Companies

When shopping for car insurance online, it’s crucial to choose reputable insurance companies. Check their financial ratings from agencies like A.M. Best, Moody’s, or Standard & Poor’s. Read customer reviews on platforms like Trustpilot or the Better Business Bureau to gauge their service quality. Consider industry awards and recognitions that indicate their commitment to excellence.

Comparing Quotes Efficiently

To compare quotes efficiently, use comparison websites that allow you to input your information once and receive quotes from multiple insurers. Obtain quotes from at least three different companies to ensure you’re getting competitive rates. Consider factors such as coverage levels, deductibles, and premiums when comparing quotes.

Understanding Policy Terms

Before purchasing an insurance policy, thoroughly read and understand its terms and conditions. Pay attention to coverage limits, exclusions, and any specific requirements or restrictions. If you have any questions or need clarification, don’t hesitate to contact the insurance company or consult with an insurance agent.

Working with an Insurance Agent

While online shopping offers convenience, working with an insurance agent can provide personalized advice and support. An agent can help you assess your coverage needs, compare quotes, and guide you through the policy selection process. They can also assist with claims handling and provide ongoing support throughout your policy term.

Government Assistance Programs for Car Insurance

In Illinois, low-income drivers may qualify for government assistance programs that can help them obtain affordable car insurance.

One such program is the Illinois Low-Income Vehicle Insurance Program (ILVIP). ILVIP provides financial assistance to eligible drivers to purchase liability insurance, which is required by law in Illinois. To be eligible for ILVIP, drivers must meet certain income requirements and have a valid driver’s license.

Benefits of ILVIP

- Provides financial assistance to low-income drivers to purchase liability insurance.

- Helps ensure that low-income drivers have access to affordable car insurance.

- Promotes safe driving by requiring participants to maintain a clean driving record.

Additional Tips for Finding Cheap Car Insurance

Beyond the strategies Artikeld above, consider these additional tips to secure the most affordable car insurance in Illinois:

Negotiating with insurers can sometimes yield lower premiums. Contact your insurer and inquire about potential discounts or payment plans that may reduce your monthly payments. It’s worth exploring this option to see if you can negotiate a more favorable rate.

Seek Professional Advice

If you’re struggling to find affordable car insurance on your own, consider seeking professional advice from an insurance agent or broker. These professionals have extensive knowledge of the insurance market and can help you compare quotes, negotiate with insurers, and find the best coverage for your needs at a competitive price.

Conclusion

In conclusion, finding cheap car insurance in Illinois requires a multifaceted approach that involves understanding the factors that affect rates, shopping around for the best coverage, and taking advantage of discounts and other cost-saving measures. By following the strategies Artikeld in this guide, consumers can secure affordable car insurance without compromising on essential coverage.

To reiterate the key recommendations for finding cheap car insurance in Illinois:

Shopping Around and Comparing Quotes

- Obtain quotes from multiple insurance companies to compare coverage options and rates.

- Use online quote comparison tools or work with an insurance agent to gather quotes efficiently.

Maintaining a Good Driving Record

- Avoid traffic violations and accidents to maintain a clean driving history.

- Consider taking a defensive driving course to improve your driving skills and qualify for discounts.

Taking Advantage of Discounts

- Inquire about discounts for good students, safe drivers, multiple vehicles, and other qualifying factors.

- Explore usage-based insurance programs that reward safe driving habits.

Increasing Deductibles

- Raising your deductible can significantly lower your premium.

- Choose a deductible that you can comfortably afford to pay in the event of an accident.

Bundling Car Insurance

- Combining car insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

- Contact your insurance company to inquire about bundling options.

Negotiating with Your Insurance Company

- Don’t hesitate to negotiate with your insurance company for a lower rate.

- Provide documentation of your good driving record, discounts, and other factors that support your request.